Jasmine Jenkins

Senior Product Marketing Manager

Courtney Chuang

VP of Marketing

Today, we’re excited to announce our winter ‘25 product roundup. This release features new enhancements across Transaction Monitoring, Customer Screening, and Hummingbird AI – giving you even more ways to automate your compliance workflows.

Earlier this year, we introduced two new solutions – Transaction Monitoring and Customer Screening – giving compliance teams one place to detect, understand, and act on risk. This release makes both solutions even more powerful and easier to operationalize. You’ll find new rule and alert capabilities for our Transaction Monitoring solution, expanded coverage and configuration options for our Customer Screening solution, and much more.

We’re also delivering enhancements across the entire platform. Hummingbird AI can now help you complete even your most complex cases. Compliance teams can also take advantage of automated STR filing in Luxembourg and more ways to eliminate repetitive and routine tasks using Hummingbird Automations.

Read on to explore all of our new features and product enhancements, including:

Connected directly to your cloud data warehouse, Hummingbird’s Transaction Monitoring solution delivers unparalleled flexibility in monitoring for your unique risks. It’s now even more powerful with new capabilities to enrich alerts for fast, informed investigations, preview rules using test mode, analyze rule performance, and more.

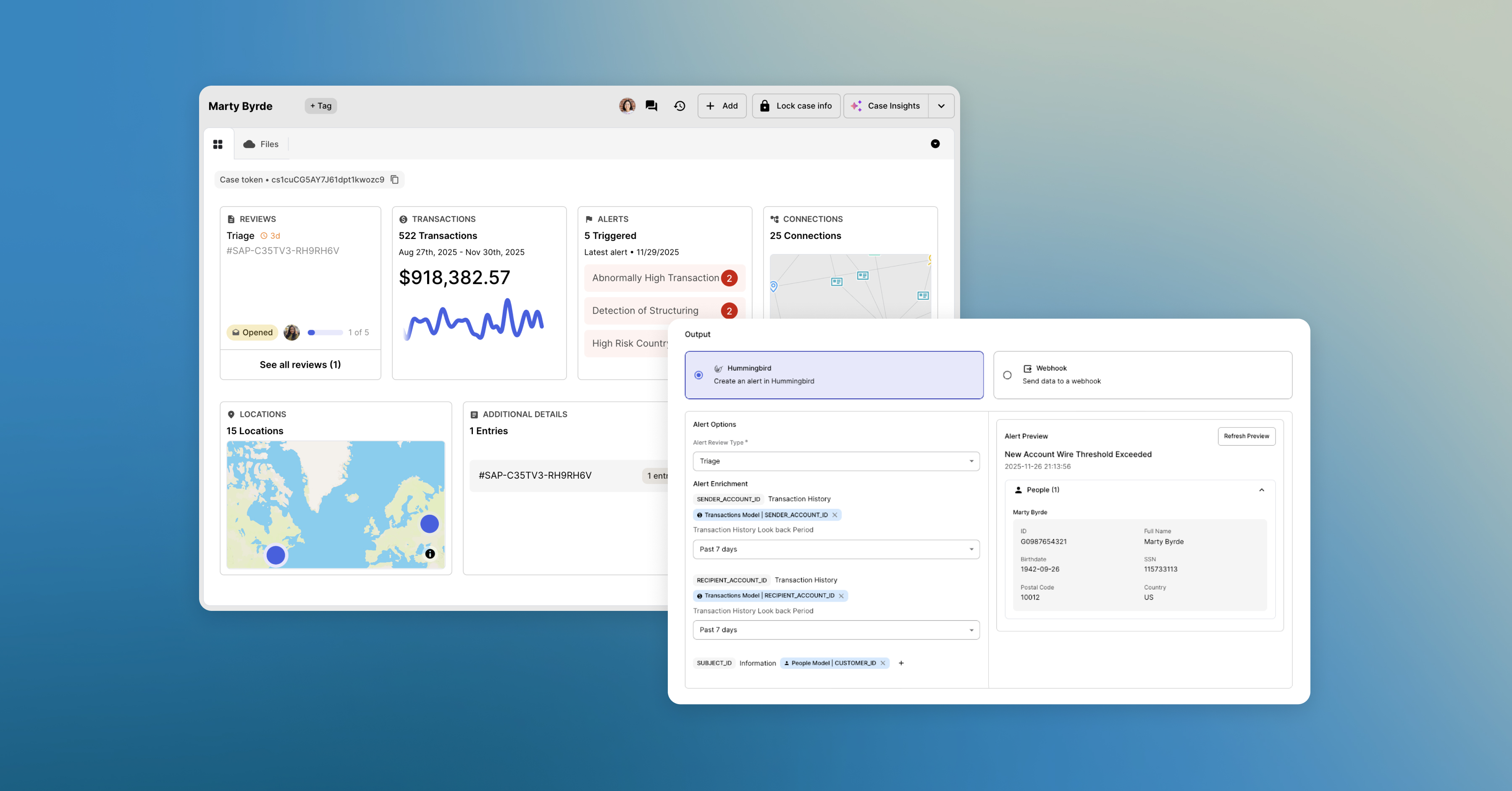

Hummingbird automatically enriches cases with data related to your monitoring alerts – and, now, with customizable alert enrichment, we’re giving you complete control over what information gets pulled in. For every rule, you can tailor the data that’s included based on the specific context that your analysts need. Simply configure which queries should be used to pull in data for associated transactions, subjects, accounts, and more, and configure the lookback windows for historical transaction activity. No more manual data entry or tab-switching – just rapid triage and smart, informed investigations.

With test mode, you can validate that rules behave as expected before setting them live. Test mode runs rules against new data but does not create any alerts, giving you a safe environment to confirm matching records, fine-tune rule logic, and assess expected alert volume.

Gain clear visibility into how your monitoring rules are performing. New analytics on alert volume and outcomes help you understand the effectiveness of individual rules and make ongoing optimizations.

With Hummingbird’s Customer Screening solution, you can unify your sanctions, PEP, and adverse media workflows in one place. Our newest capabilities make your screening workflows more precise, configurable, and aligned with your risk policies.

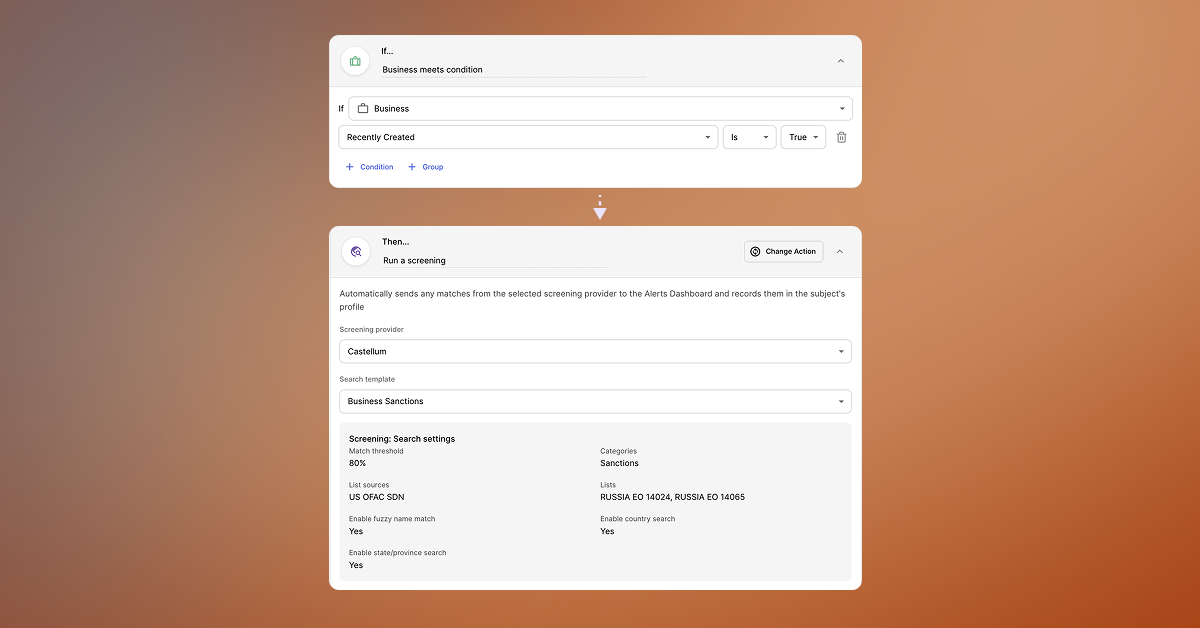

In addition to screening individuals, you can now run automated and ad-hoc screening for businesses directly in Hummingbird.

Our Castellum.AI integration now supports sanctions, PEP, and adverse media screening, giving you a more complete picture of customer risk. You can also fine-tune your screening by specifying list sources (e.g., OFAC), narrowing results by country or jurisdiction, and filtering adverse media by topic – such as bribery, fraud, or corruption. These granular controls help you reduce false positives and surface results most relevant to your customers’ risk profile.

With our customizable screening templates, you can define the settings that you want to use for different customer profiles or types of screening (e.g., sanctions vs. adverse media). Now, you can use those templates as part of your automated workflows for screening people and businesses. For example, you might screen high-risk customers using a template with stricter match thresholds. This ensures each automated screening uses the logic that best aligns with your risk policies.

Hummingbird's Narrative AI makes it fast and easy to summarize case findings, and now it supports even your most complex cases. Using narrative templates, you can provide specific instructions to the AI. New support for conditional logic makes these templates even smarter, allowing the AI to more intelligently decide what to include in the narrative depending on what data is present in the case.

The way it works is straightforward: The AI will follow any “if/then” logic that you specify in the template and then automatically include or omit certain information. An example statement might look like “If repayment data exists, include these details; if not, skip this section.” Whether you’re summarizing triage findings, writing up due diligence reviews, or drafting SAR narratives, Narrative AI can account for the nuances of any scenario and the details of the specific case at hand – taking a time-intensive task off your team’s plate.

From support for new filing jurisdictions to new automation capabilities, this release includes several improvements to help your team work more efficiently in Hummingbird.

With filing workflows, automated report generation, and more, Hummingbird gives you everything you need to manage regulatory reporting in one place. We’ve now expanded our automated STR report generation capabilities to include Luxembourg, adding to our growing support for global jurisdictions.

Reports are automatically generated in the correct format and prepared for external submission to the FIU, making it faster and easier to complete filings for this jurisdiction. You can also maintain a complete record of filing activity with detailed audit trails and customizable workflows – helping ensure accuracy, visibility, and consistency across your reporting process.

Compliance work often involves repetitive tasks that take time away from higher-value strategic work. Hummingbird Automations, our intuitive, no-code automation builder, makes it easy to streamline those tasks so your team can work faster. Our latest enhancements give you even more ways to reduce the manual work on your team’s plate.

Use case and profile tags in automation recipes: Tags make it easier to identify and categorize cases and customer profiles, and now you can automatically apply them. You can use tags in your trigger conditions – for example, if a person has a "Sanctions Alert" tag, you could automatically create a sanctions review. You can also add tags as an action, such as tagging a case “Fraud” based on the review type.

Hummingbird brings together transaction monitoring, customer screening, investigations, and regulatory reporting in one unified platform – giving compliance teams a single place to orchestrate their most important workflows. Our solutions integrate easily with existing systems and scale as your business evolves.

If you’re ready to empower your team to work faster and smarter, schedule a demo today. You’ll get a firsthand look at the platform that innovative banks and leading fintechs – including Etsy, BILL, DraftKings, and Celtic Bank – trust to run their risk and compliance programs.

If you are a current customer, learn more by signing in to Hummingbird and visiting our help center or reaching out to our team at support@hummingbird.co.

Subscribe to receive new content from Hummingbird